It might be seven years since the first signs that the world was about to go into crisis mode, but we're not home and dry yet. In fact, recent cheers at nascent signs of a global economic recovery now look somewhat premature, analysts and politicians warn.

Fears of a setback were heightened on Monday following some surprise news from Japan: the world's third-largest economy fell into recession after gross domestic product (GDP) shrank in the third quarter.

It came as British Prime Minister David Cameron warned that the global economy was showing worrying signs of wobble. Meanwhile, at the G-20 summit over the weekend, OECD Chief Economist Catherine Mann told CNBC the global economy should be growing at a much faster pace.

Read MoreUK PM warns on second global crash

Here, CNBC takes a look at some of the biggest economic pressure points:

Japan woes

Data published on Monday revealed that Japan's economy contracted an annualized 1.6 percent in the July-September quarter, way below a Reuters forecast of a 2.1 percent gain.

The figures mean Japan is now back in a technical recession, after contracting a revised 7.3 percent in the second quarter following a hike in a controversial sales tax.

Read MoreJapan shocks as economy slips into recession

As a result, analysts now expect Japan's Prime Minister Shinzo Abe to delay another planned rise in the levy – an austerity measure – until 2017, and maybe even call a snap election.

But it's not all bad news for Japan, with Takuji Aida, chief economist at Societe Generale, saying that as delay to the sales tax hike would be bullish for the economy's outlook.

"With the second consumption tax delayed, uncertainty over the economy will decrease and growth and inflation expectations will rise, leading to stronger corporate activity," Aida said in a note.

Oil at lows

The news from Japan – which is the world's fourth-biggest crude importer – put yet more pressure on oil prices, which have fallen dramatically in recent months. On Monday, Brent crude fell close to $78 a barrel.

Read MoreCracks widen at OPEC as oil prices tumble

The fall below $80 has rattled nerves within the Organization of the Petroleum Exporting Countries (OPEC), amid calls for concrete action from the group, with both Kuwait and Iran raising concerns about the lows. This after the International Energy Agency (IEA), warned last week that weak demand, a strong dollar and booming U.S. oil production meant "we have begun a new chapter in the history of the oil markets."

"Investors are becoming reluctant to try and pick the bottom now, as are consumers, many of whom are holding off to see what OPEC does," Investec Capital Markets analysts said in a note.

Low oil prices are something of a double-edged sword for the global economy: On the one hand helping to boost GDP, but on the other putting downward pressure on inflation. Price growth remains worryingly low in Europe and the U.K. and there are some concerns in the U.S., where long-term inflation expectations fell to financial crisis levels, according to the University of Michigan consumer sentiment survey on Friday.

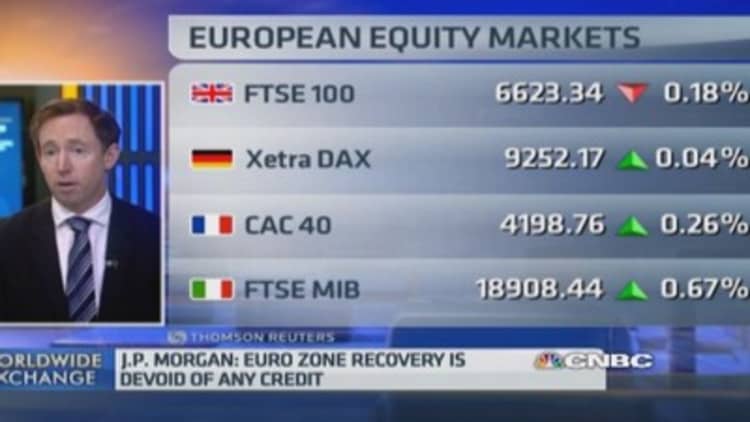

Euro zone stagnation

Growth-sapping low inflation is particularly concerning in the euro zone, where prices grew by just 0.4 percent in October. The region is also battling high unemployment, which remained stuck at 11.5 percent in September.

There might have been some good news over recent days - with figures on Friday showing the euro zone's economy grew more than expected, and data on Monday revealing that the trade surplus jumped to a record 17.7 billion euros ($22.1 billion) in September - but serious concerns about the region remain.

Despite beating forecasts, the 18-country bloc that uses the euro grew by just 0.2 percent on the previous quarter – a pretty flat figure.

"Overall, the Q3 picture was a touch better than feared," Daiwa Capital Markets analysts said in a not. "But there seems little reason to expect the euro area recovery to progress much further in the near term unless the ECB (European Central Bank) and governments do more for growth."

Read MoreECB's Draghi: Buying sovereign bonds is an option

Pressure remains on ECB President Mario Draghi to do more. The central bank has already launched a slew of stimulus measures to reverse disinflation – and a number of experts are now calling for a U.S. Federal Reserve-style bond-buying program.

On Monday, Draghi reiterated that he was willing to do more to stimulate the euro zone economy if necessary, adding that such additional measures could include the purchase of sovereign bonds.

- By CNBC's Katrina Bishop